For decades, JAG has specialized in providing investment strategies and services to socially responsible investors.

We provide investment solutions that seek to preserve capital, provide income for current needs and long-term growth for the future, while incorporating ethical standards into the investment management process.

JAG is a committed fiduciary and partner in your stewardship efforts. We believe active investing, informed by independent thinking, gives you the best possibility of achieving superior investment returns.

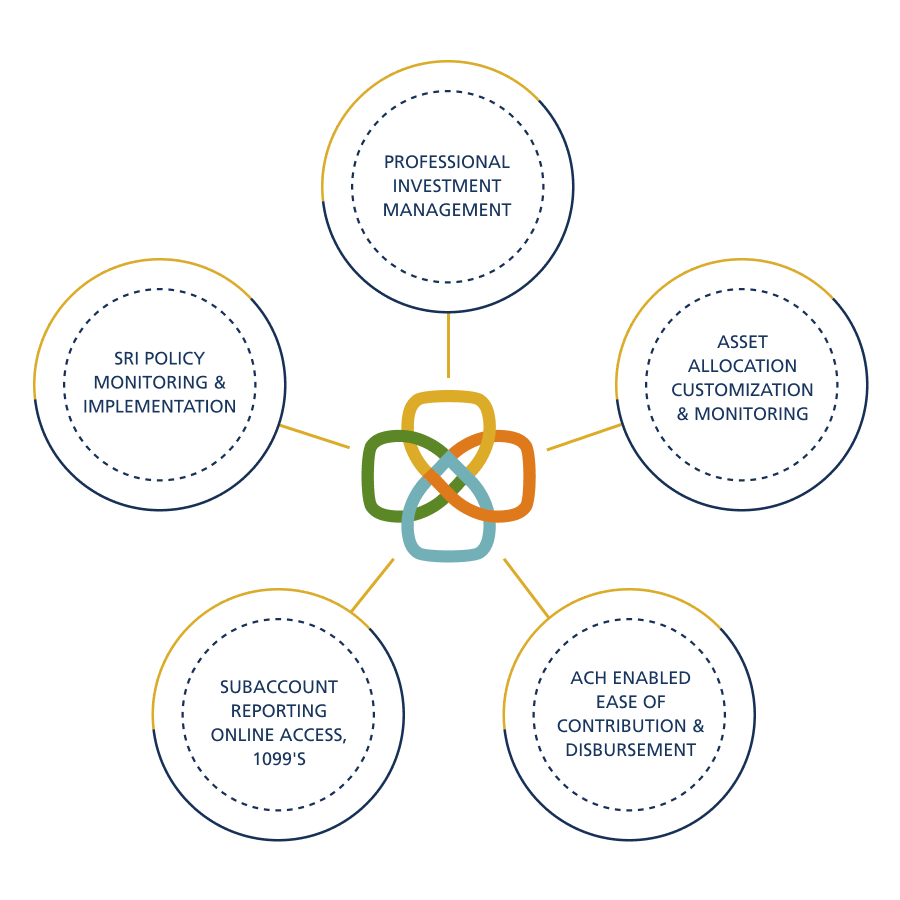

Building on our history of partnering with religious institutions, our Patrimony Turnkey Solution provides investment oversight and administrative support in one integrated offering.

Explore how JAG Capital Management can help you pursue your goals with clarity, discipline, and purpose.