September 2024

Summary

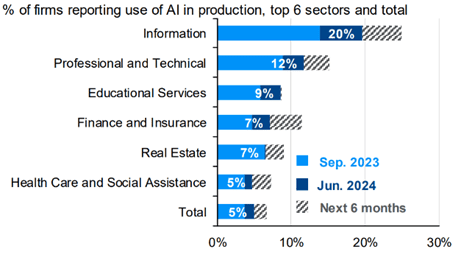

We have extensively covered Gen AI developments in our previous Insights pieces and Q2 earnings season commentary was consistent with our expectations. Almost all of the world’s largest companies continue to prioritize AI infrastructure buildout. For example, Microsoft’s (MSFT) most recent quarterly capex was $19B and management noted that “cloud and AI-related spend represents nearly all of our total capital expenditures.” Alphabet (GOOGL) and META (formerly Facebook) also signaled that they would maintain elevated levels of AI-related spending. We believe investments into AI will remain robust for the foreseeable future as the adoption expands outside of Tech as well.

Despite these large investments in Gen AI, monetization is still very much a question. Should companies struggle to effectively monetize their Gen AI products, there is a risk that AI capex falls sharply. We could draw a historical parallel to…