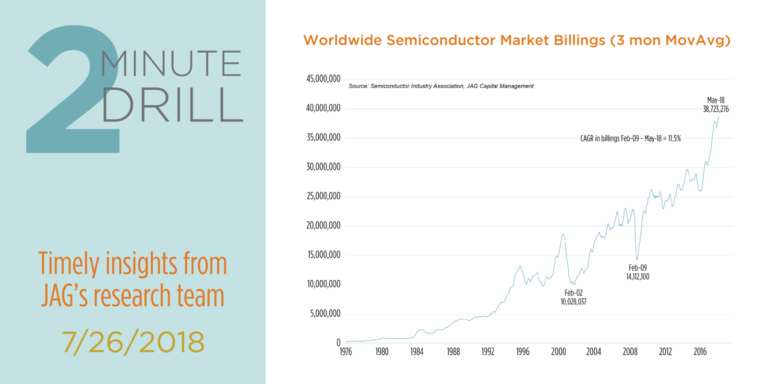

Semiconductors quite literally make the global technology industry possible. According to the Semiconductor Industry Association (SIA), the chip industry directly employs almost a quarter million people in the U.S., and domestic semiconductor sales total almost $200 billion. Semiconductor billings have been skyrocketing over the past decade, growing at an annualized rate of 11.5% between February 2009 and May 2018. However, seasoned investors know that these companies are cyclical, and some are questioning whether chip stocks are experiencing peak sales and earnings. For those (like us) who are invested in chip stocks, it is vital to keep a close eye on a potential negative inflection point in the industry. From our standpoint, we do not currently see a cycle peak on the near/intermediate term time horizon. We think it is important to recognize that datacenters are growing at a torrid pace, and they need a boatload of chips to work efficiently. Our thesis, in turn, is that datacenters may be making the semiconductor industry incrementally less cyclical than it was in the past.

Semiconductor equipment companies produce the complex (and expensive) machines that are used to manufacture semiconductor chips. Although both industries are tied to the world’s insatiable demand for chips, their stock prices exhibit very dissimilar returns over various slices of time. This chart demonstrates the relative performance between the Semiconductor Equipment Index and the Semiconductor Index. Note that when the blue line is rising, the manufacturers are outperforming the chip makers. When the blue line is declining, the opposite holds true. Between October 2015 and October 2017, the equipment companies generated monstrous relative gains. Since then, however, the Semiconductors Index has gained almost 16%, compared to an 11% decline in the Equipment Index. From a technical perspective, we think further relative price weakness in the Semiconductor Equipment Index could create a very compelling investment opportunity in select equipment stocks. To be a bit more specific, we would be especially interested if the relative performance line approached the level reached back in late 2015.