JAG Growth Equity Thematic Insights: Q1 2026

February 2026 Investing in Transformation That Matters Software at the AI Crossroads SaaS (Software as a Service) stocks have come under increasing pressure as AI tools such as Anthropic’s Cowork have stoked concerns around commoditization and slower seat growth. Many software companies will continue to thrive and create attractive opportunities for investors, but the gap […]

JAG Growth Equity Thematic Insights: Q4 2025

December 2025 Investing in Transformation That Matters Need For Speed: Silicon Edition The AI landscape continues to evolve rapidly, with recent headlines highlighting a growing competitive threat to Nvidia (NVDA) as Google (GOOGL) is reportedly considering external sales of its custom AI accelerator chip, the tensor processing unit (TPU). This note will outline why Nvidia […]

JAG Fixed Income Thematic Insights: Q4 2025

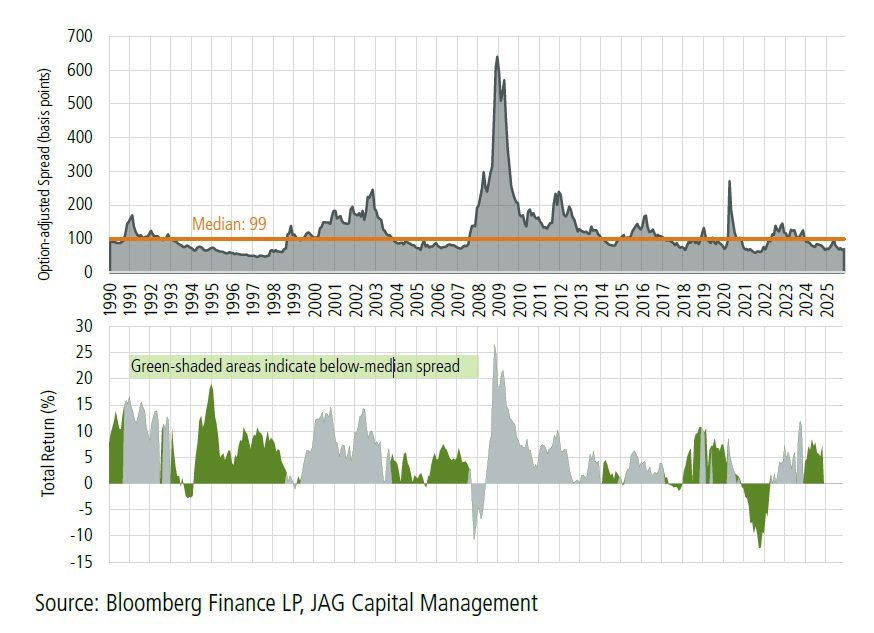

December 2025 – Spread Thin? Why Credit Still Deserves a Place in Portfolios Summary In last quarter’s Insight, we examined the relationship between yield levels and forward return outcomes, illustrating how higher absolute yields improve the odds of favorable results over time. This quarter, we turn to a related but more nuanced factor: credit spreads. […]

JAG Growth Equity Thematic Insights: Q3 2025

September 2025 Investing in Transformation That Matters Staying Disciplined Amidst a Boom As we move through the end of the third quarter of 2025, the fierce arms race in Artificial Intelligence (AI) is continuing to gain steam. Investors are pouring capital into AI-focused companies at a frenetic pace, chasing the promise of revolutionary breakthroughs. Read […]

JAG Fixed Income Thematic Insights: Q3 2025

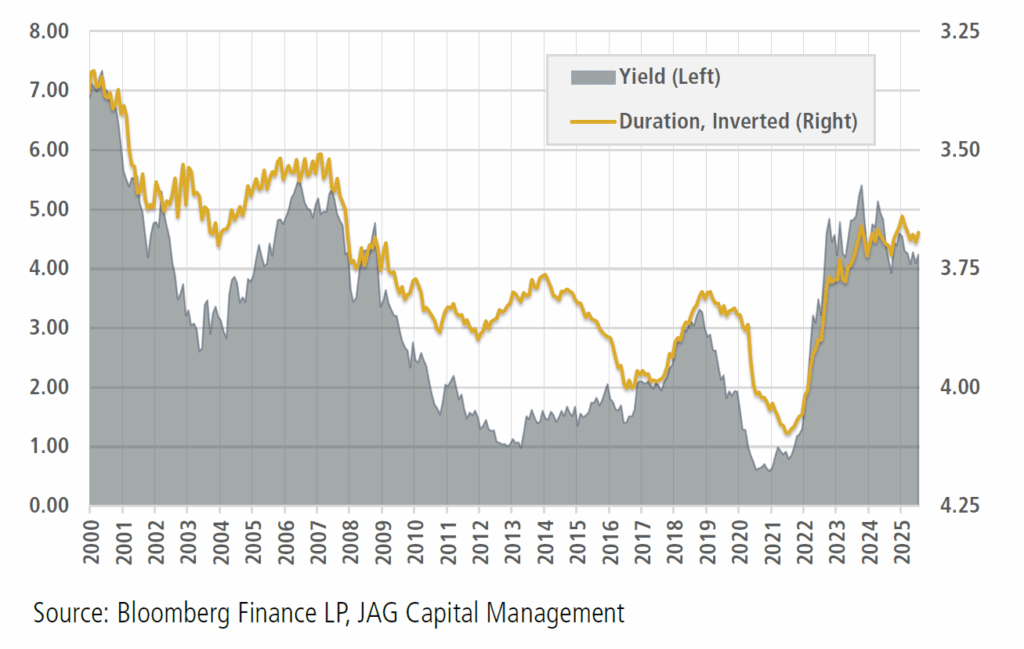

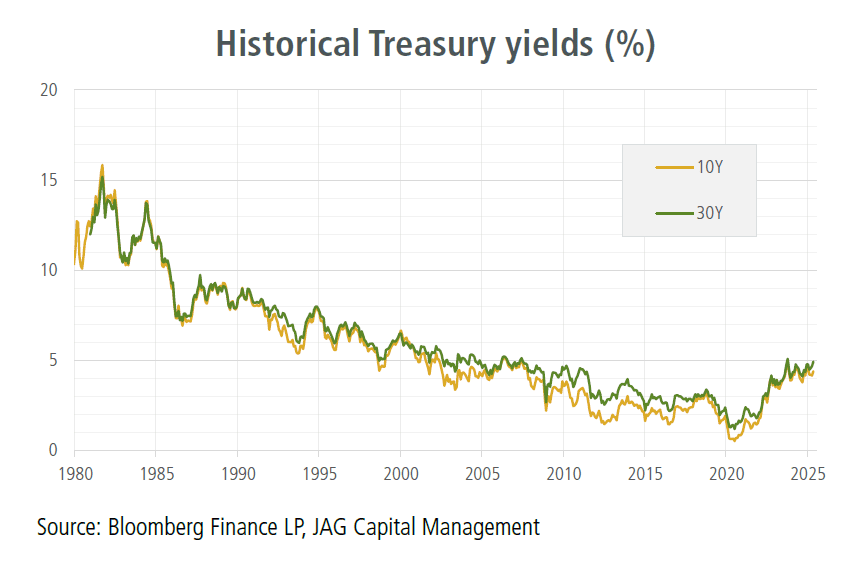

September 2025 – Beyond the Yield: A Risk-Based Case for Bonds Summary JAG has maintained a constructive bond market outlook for several years, enduring bouts of volatility, tight credit spreads, and a prolonged yield curve inversion. Despite evolving risks, we consistently reach the same conclusion: absolute yields remain attractive. While this view may sound simplistic, […]

JAG Growth Equity Thematic Insights: Q2 2025

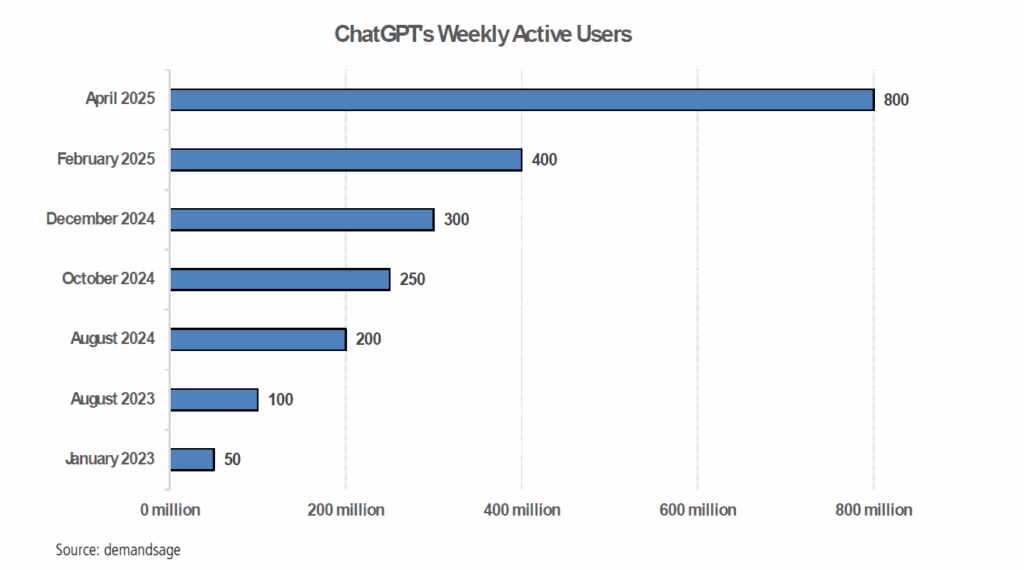

June 2025 Investing in Transformation That Matters Beyond the Headlines, the AI Revolution Continues Although tariff policy, government spending, and politics have dominated the news coverage in recent weeks, we are closely monitoring longer-term catalysts for innovation and disruption including Artificial Intelligence (AI). Read more

JAG Fixed Income Thematic Insights: Q2 2025

June 2025 – Treasury Market Primer: Back to Textbook Basics? Summary As we enter the final weeks of Q2 – and at the risk of speaking too soon – several key markets may finish the quarter essentially unchanged from Q1. This seeming calm, however, obscures the roller-coaster of volatility investors endured in the first two […]

JAG Growth Equity Thematic Insights: Q1 2025

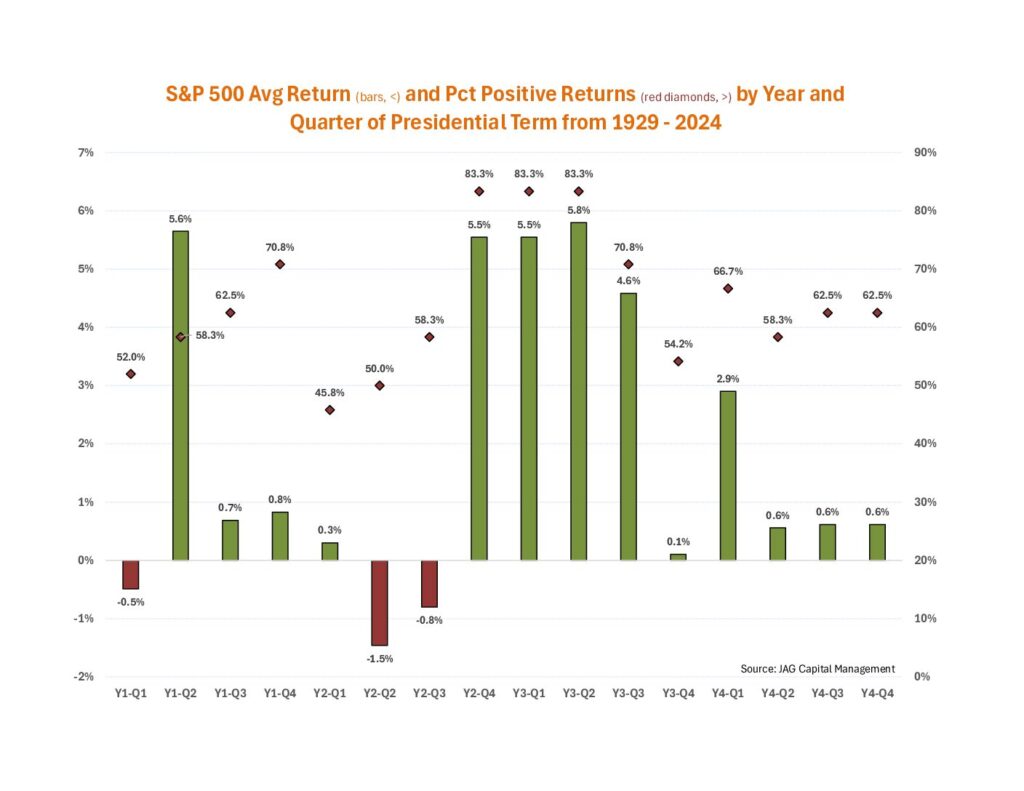

April 2025 If you’re feeling a bit overwhelmed by the tsunami of news so far in 2025 – rest assured, you are not alone. The financial markets have been struggling to stay abreast of waves of market-moving headlines that have been breaking virtually nonstop in recent weeks. In response to this rapidly changing and uncertain […]

JAG Fixed Income Thematic Insights: Q1 2025

March 2025 – Context on Credit Spreads: Should Investors be Concerned? Summary Our clients routinely ask us to comment on the overall levels and trends in corporate credit spreads. For the last year or so, these inquiries have taken on a greater sense of urgency as spreads have tightened significantly. While we agree that the […]

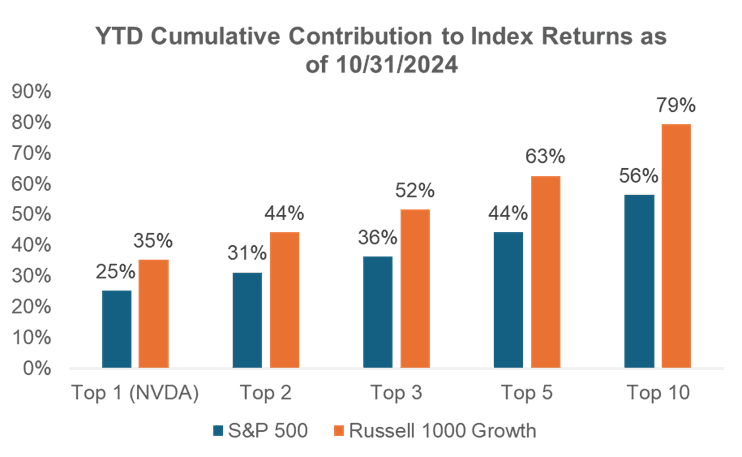

JAG Growth Equity Thematic Insights: Q4 2024

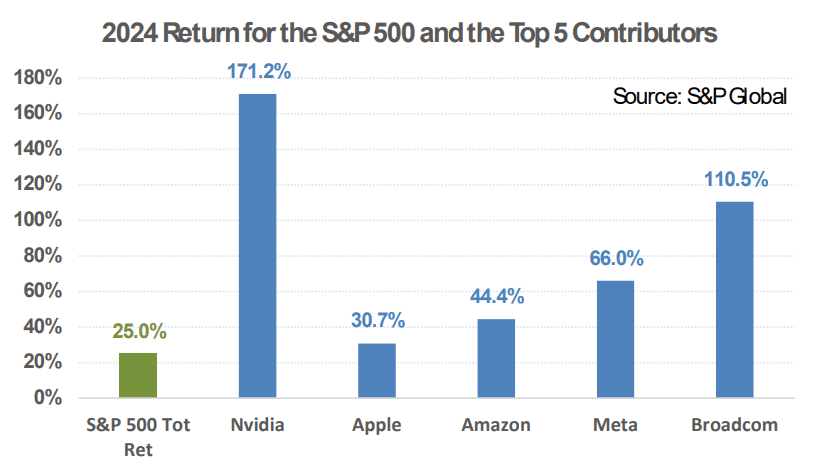

December 2024 How to Invest in Concentrated Markets In our previous Insights pieces, we’ve explored key market themes, including the emergence of Generative AI and the growing impact of GLP-1 drugs on healthcare and consumer products. In this write-up, we will discuss a topic that has been garnering considerable attention – market returns being driven […]