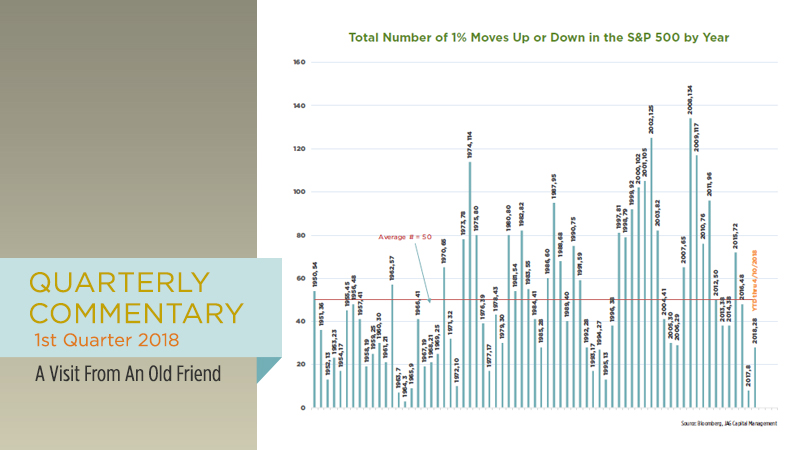

1st Quarter 2018: A Visit From An Old Friend

Market volatility has returned from an extended vacation, resulting in a roughly 10% correction for the S&P 500 since its January high and a -.8% decline for the 1st quarter of 2018. This was the index’s first 10% correction in two years, and it broke a streak of nine consecutive quarterly gains dating back to […]

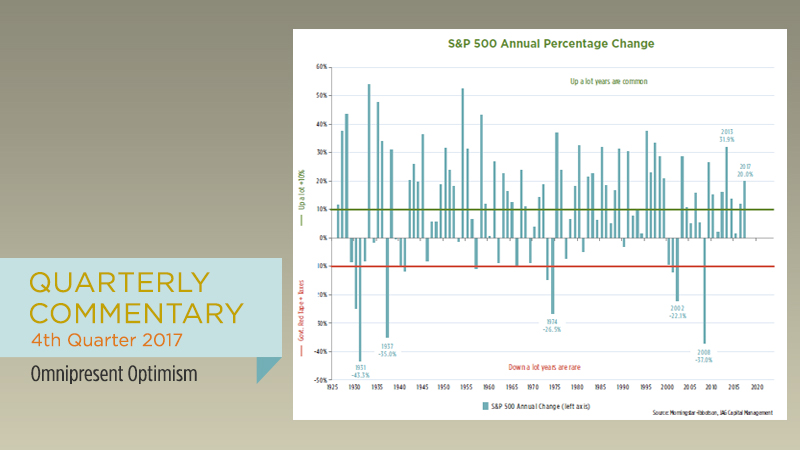

4th Quarter 2017: Omnipresent Optimism

Stocks roared into the New Year, with the S&P 500 delivering a 6.64% return in the fourth quarter of 2017. For the full year, the benchmark index returned 21.83% (both figures include the effect of dividends). It is worth noting how surprising last year’s stock market performance was to most of the cognoscenti on Wall […]

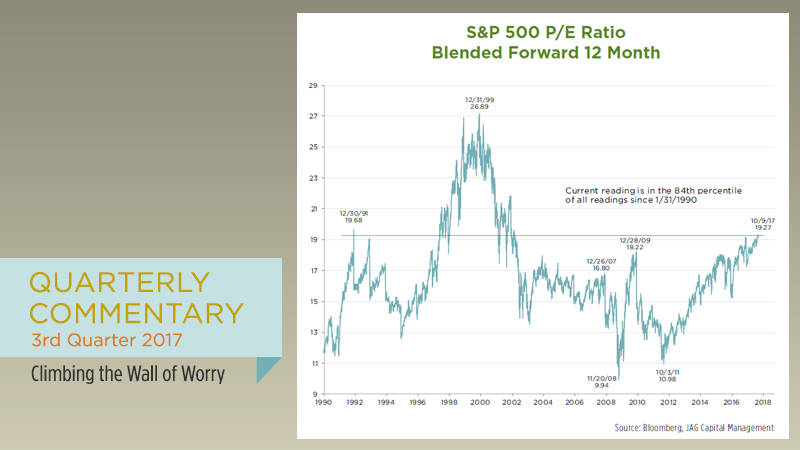

3rd Quarter 2017: Climbing the Wall of Worry

The bulls continued to run on Wall Street last quarter, pleasantly surprising many individual and professional investors. The S&P 500 Index gained over 4% for the three months ending September 30, 2017, bringing its year-to-date total return to 14.24% (including dividends). The benchmark index has now returned more than 278% since March 2009, which works […]

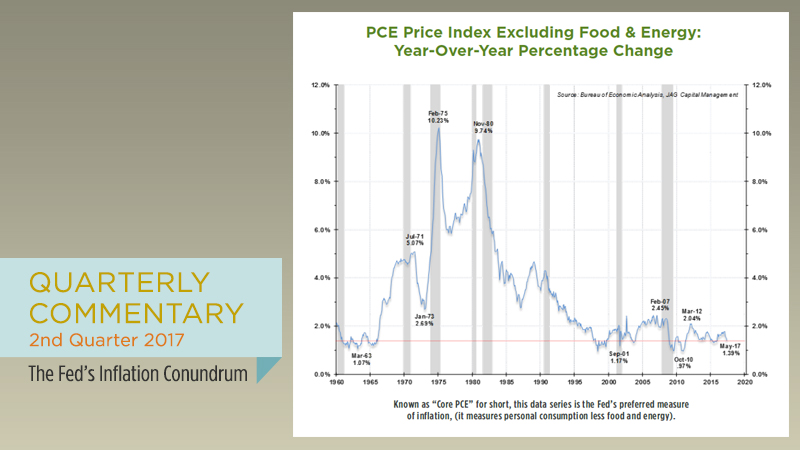

2nd Quarter 2017: The Fed’s Inflation Conundrum

What the heck is going on with inflation? In the 1970’s and 1980’s, rampantly rising prices were the bane of our economy (the cartoon to the right was published in 1974). But today, despite years of intensive stimulus from central bankers around the world, inflation is nowhere in sight. For those who follow economic and […]

1st Quarter 2017: Attitude Adjustment

Stocks got off to a strong start during the first quarter of 2017, albeit with a new cohort of leaders. As a reminder, cyclical stocks were the best performers during last year’s fourth quarter. Following the astonishing-to-most outcome of the Presidential election, capital rushed into the shares of companies which were perceived to be the […]

4th Quarter 2016: The Bonfire of Consensus

What a year we had in 2016! As a group, experts and prognosticators across the political and investing realms have never been so spectacularly wrong about so many things. Here is just a short list of some of the more confounding events of last year: U.S. stocks delivered flattish returns in 2015, and began 2016 […]

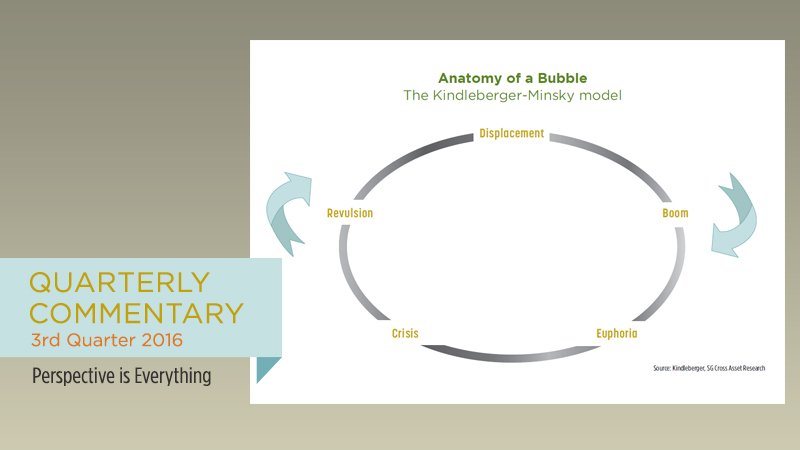

3rd Quarter 2016: Perspective is Everything

One of the most frustrating but central tenets of investing is that successfully predicting the short-term future path of the stock market (i.e. market timing) is essentially impossible. Indeed, to paraphrase Ken Fisher, price movements seem almost predestined to embarrass and confuse as many people as possible. This year’s particularly confounding stock market action is […]