3rd Quarter 2020: Navigating the 2020 Elections

Firm Highlights JAG continues to make long-term investments in our clients and our future growth. Over the last six months, we have welcomed three team members to our St. Louis and Chicago offices. Gregory Lowhorn joined our business development team in St. Louis, and we recently hired Jason Ng as an equity research analyst. Sheryl […]

2nd Quarter 2020: Markets Make An Optimistic Forecast

Now this is not the end. It is not even the beginning of the end. But it is, perhaps, the end of the beginning. – Winston Churchill, from a speech in 1942 Markets Make an Optimistic Forecast It is almost impossible to overstate how tumultuous 2020 has been thus far. Indeed, for those of us who […]

1st Quarter 2020: Notes From Quarantine

The first quarter of 2020 will be remembered in decades to come as a time of significant and extremely compressed changes to the global economy, society, and the capital markets. Over the span of less than 30 days beginning in midFebruary, mitigation of the COVID-19 pandemic emerged as the sole focus of policymakers, business owners, […]

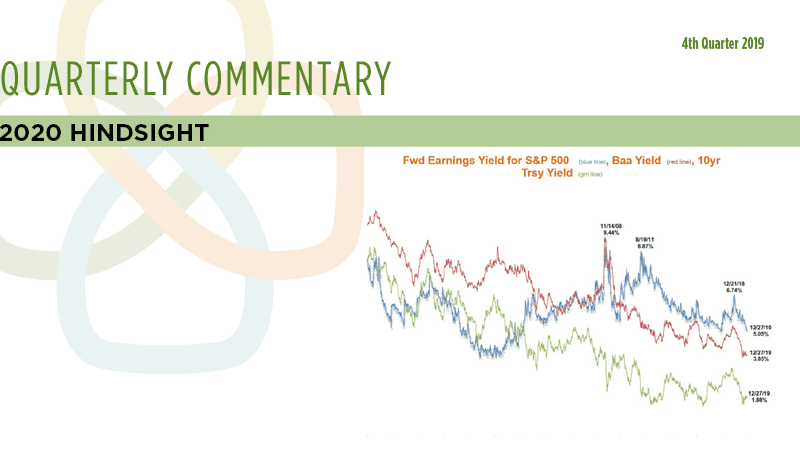

4th Quarter 2019: 2020 Hindsight

Stocks broke out to all-time highs in the 4th quarter, after spending the prior three quarters struggling to meaningfully eclipse the previous highs set in October 2018. Even if we had been granted the magical opportunity to read last year’s headlines in advance, our guess is that most of us would have vastly underestimated equity […]

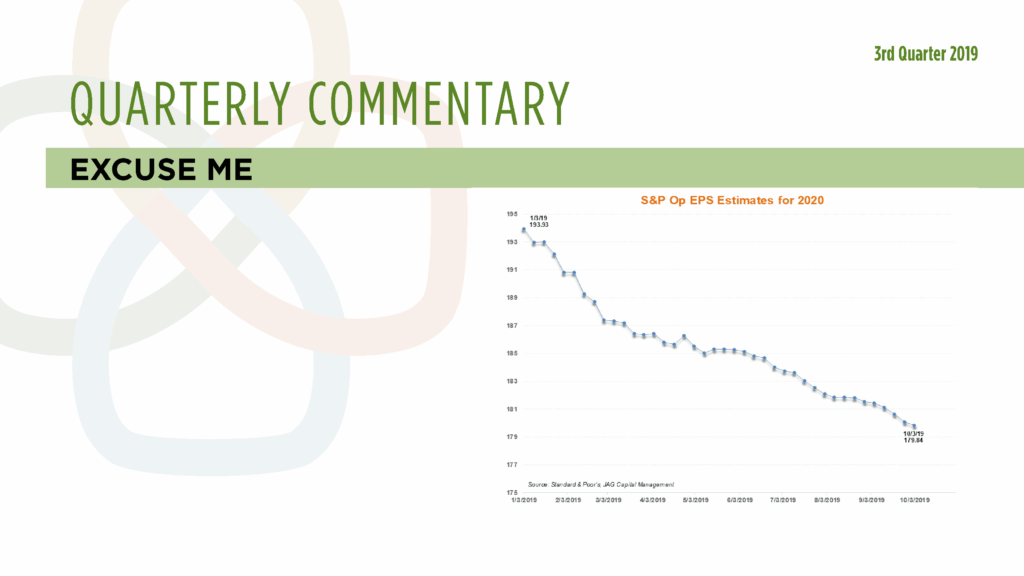

3rd Quarter 2019: Excuse Me

Although stocks are up nicely so far in 2019, the S&P 500 is trading essentially flat with levels it was at in January 2018. This lackadaisical performance over the past 20 months comes despite modest growth in corporate earnings, and it obscures a sharp 20% correction that hit the market hard during last year’s 4th […]

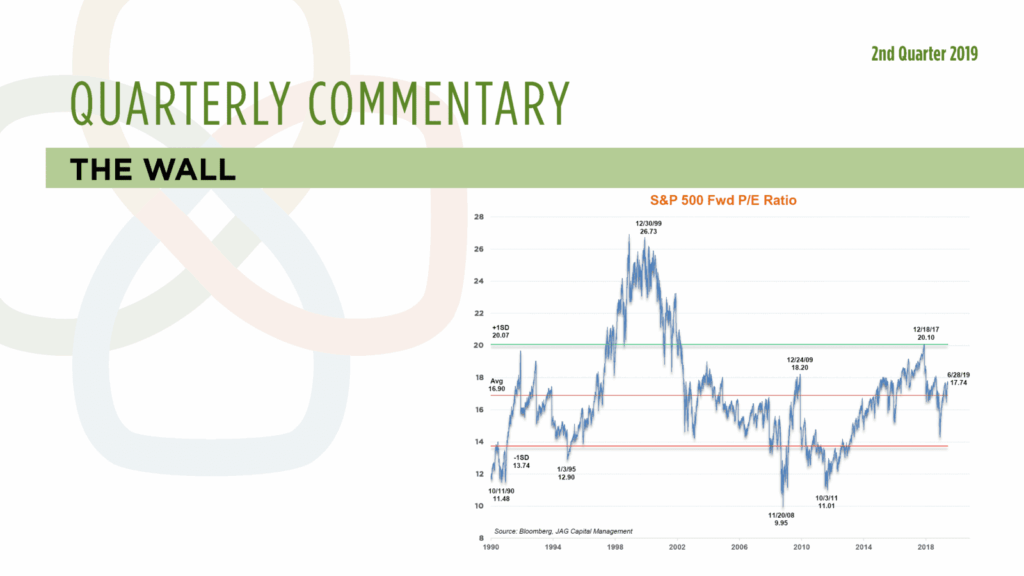

2nd Quarter 2019: The Wall

As most of our clients and friends are aware, we do not make stock market forecasts. In fact, we believe short-term market prognostications are almost always unworthy of the time spent to produce or consume them, as we do not think anyone can reliably predict gyrations in asset prices in advance. That said, we can […]

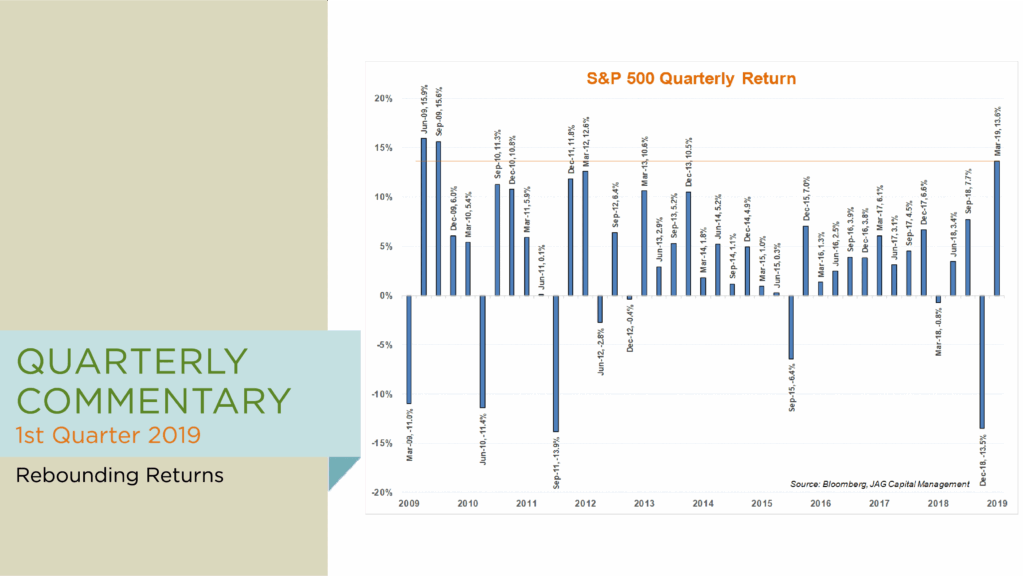

1st Quarter 2019: Rebounding Returns

Storm clouds gave way to sunshine for investors during the first quarter of 2019, resulting in very strong returns for risk assets. The S&P 500 Index posted a 13.65% return in the three months ending 3/31/19, representing its best quarterly gain since late 2009 and its best first quarter since 1998. As if investors needed […]

4th Quarter 2018: A “Glitch” Down the Stretch

Love him or hate him, our President does not typically display a penchant for understatement. So, we were a bit surprised to hear Mr. Trump dismiss the recent stock market decline as a “little glitch.” Love him or hate him, our President does not typically display a penchant for understatement. So, we were a bit […]

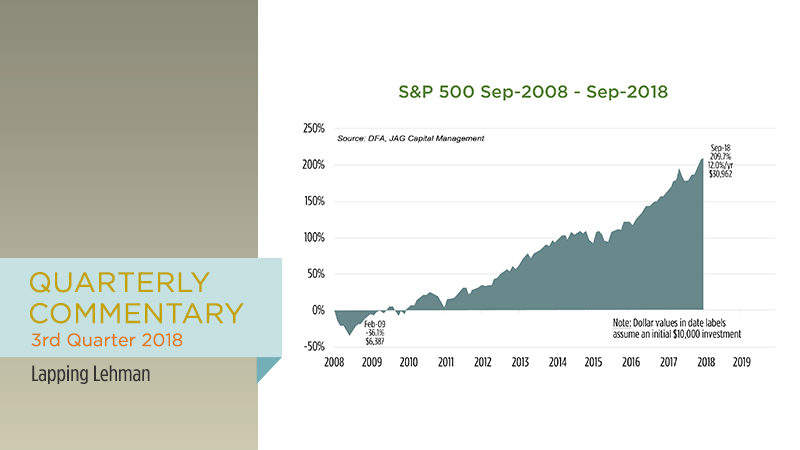

3rd Quarter 2018: Lapping Lehman

Investment performance is often measured in convenient slices of time. For example, most experienced investors are familiar with mutual fund advertisements detailing a fund’s trailing 1-,3-, 5-, and 10-year performance. Of those periods, the last one – the immediate past decade of average annualized returns – tends to carry a lot of psychic weight for […]

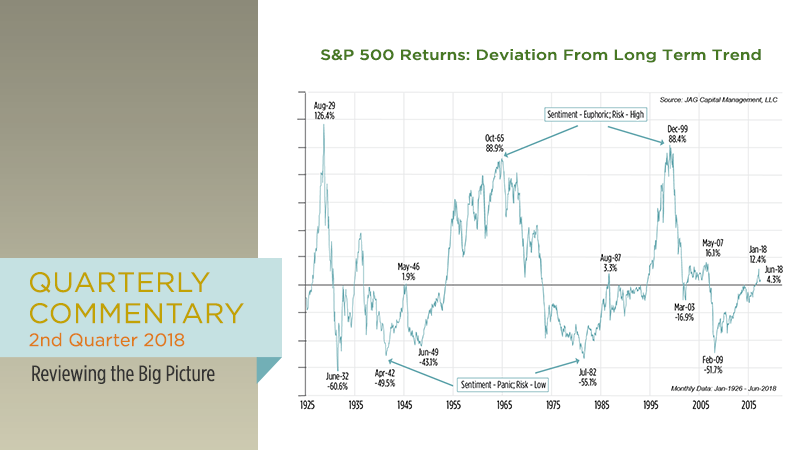

2nd Quarter 2018: Reviewing the Big Picture

The US stock market rebounded during the 2nd quarter, despite chaotic news flow highlighted by rising energy prices, a flattening Treasury yield curve, turmoil in emerging markets, President Trump’s tariff policies, and growing fears of a trade war between the US and China. The S&P 500 successfully navigated all this noise to generate a quarterly […]