Quarterly Comments Q4 2025: Resilience Amid Uncertainty

Resilience Amid Uncertainty Firm Highlights Congratulations to Mike Walsh, whom we honored for embodying our Accountable core value and for celebrating his 45th anniversary as a key member of the JAG team. Mike is a consummate professional and tireless advocate for our clients. His dedication also extends beyond our firm, through his longtime service on […]

3rd Quarter 2025: Markets, Machines, and Megawatts

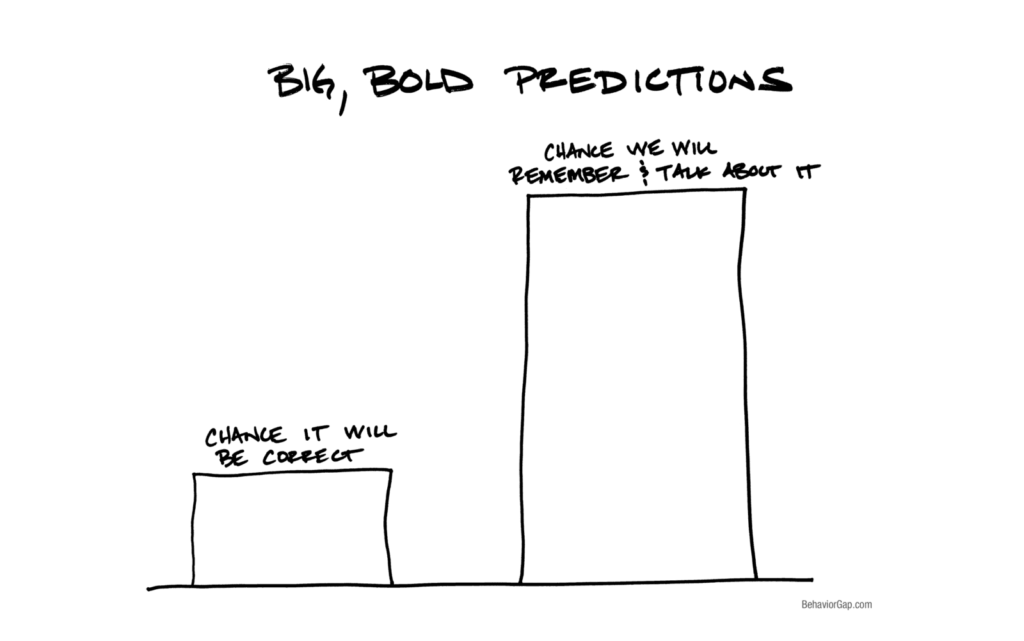

Markets, Machines, and Megawatts Markets entered the third quarter with strong momentum from the spring rebound and never looked back. The S&P 500 climbed steadily through July and August, then surged to a new all-time high in September on optimism about cooling inflation and a friendlier Fed stance. Tech stocks led the charge yet again: […]

2nd Quarter 2025: From Shock to Strength

From Shock to Strength Last quarter was nothing if not exciting. April opened with what market historians may someday call the Tariff Tantrum of 2025. On April 2, President Trump announced sweeping “reciprocal” duties that – at first blush – appeared large enough to upend global supply chains. Markets recoiled from this shocking announcement, knocking […]

1st Quarter 2025: Tariff Tantrum Turbulence

Tariff Tantrum Turbulence As usual, we completed a rough draft of this commentary a week or so prior to the end of the quarter. We had planned to deliver a relatively routine letter, which would review the events of the 1st quarter and give readers a sense of forward outlook. It might go without saying, […]

4th Quarter 2024: Back to Back Bulls

Back to Back Bulls The S&P 500 rose to an all-time high in the fourth quarter and extended 2024’s gains as the Presidential election (finally!) moved into the rear-view mirror. Despite a few modest wobbles during the year, corporate earnings growth topped most expectations, the US economy remained on solid footing and the Fed began […]

3rd Quarter 2024: Closing the Gap

Closing the Gap Stocks continued to advance in the third quarter, albeit with more volatility than experienced during the first half of 2024. Some of the market’s zigs and zags were driven by economic data, which appeared to be signaling a slowdown in the US economy. These concerns came to a head in early August, […]

2nd Quarter 2024: The Concentration Conundrum

The Concentration Conundrum Enthusiasm for Artificial Intelligence (AI) once again powered the broad market higher last quarter, as the S&P 500 generated solid gains. By market capitalization, large caps outperformed small caps in Q2, as they did in the first quarter of 2024. On a sector level, performance was decidedly mixed. Five of the 11 […]

1st Quarter 2024: Time Flies

Reflecting on 25 Years March 8th marked the 25th anniversary of my first day at JAG. In early 1999, my wife Chris and I had just turned 30 years old. Back then I thought I knew a fair amount about investing. More than two decades later, I realize that successful investing goes hand-in-hand with lifelong […]

4th Quarter 2023: A Catalyst-Driven Rally for Investors

Market Overview Stocks enjoyed a broad and powerful rally in the fourth quarter as the major US stock indices posted strong quarterly gains, including the 3rd-best combined November and December performance in the almost 100-year history of the S&P 500. After almost two years of hawkish Fed policy, investors have begun to project rate cuts […]

3rd Quarter 2023: Rising Rates Create Opportunities…And Risks

Market Overview Stocks had a strong start to the third quarter before pulling back in August and September. Overall, the S&P 500 ended the quarter with modest losses, in part attributable to another spike higher in interest rates. In our opinion, the resilience in the US economy could be contributing to the recent market volatility. […]