JAG Fixed Income Thematic Insights: Q4 2024

December 2024 Summary Clients often ask us which corporate sectors, credit tiers, or tenors of the yield curve our team finds attractive. These are reasonable questions routinely addressed by fixed income managers. We tend to reframe the premise when asked ourselves. Rather than assigning outlooks to categorized segments, we prefer to identify those segments where […]

JAG Growth Equity Thematic Insights: Q3 2024

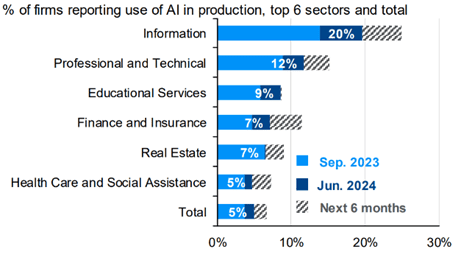

September 2024 Summary We have extensively covered Gen AI developments in our previous Insights pieces and Q2 earnings season commentary was consistent with our expectations. Almost all of the world’s largest companies continue to prioritize AI infrastructure buildout. For example, Microsoft’s (MSFT) most recent quarterly capex was $19B and management noted that “cloud and AI-related […]

JAG Growth Equity Thematic Insights: Q2 2024

June 2024 Summary “Creative destruction” is a feature of capitalism and the modern global economy. The forces of innovation push society forward and ultimately result in better products and services for consumers. For investors, the rise of diabesity medications and Artificial Intelligence present opportunities as well as risks. Read more to learn how we are […]

JAG Team Insights — Q1 2024: Thematic Insights

April 2024 Summary Esteemed investor Howard Marks once said, “We may never know where we’re going, but we sure out to know where we are.” We agree with Mr. Marks. What follows is a brief overview of several of JAG’s Growth Portfolio Themes. Artificial Intelligence Secures Its Place GLP-1’s – A Disruptive Force in Medicine […]

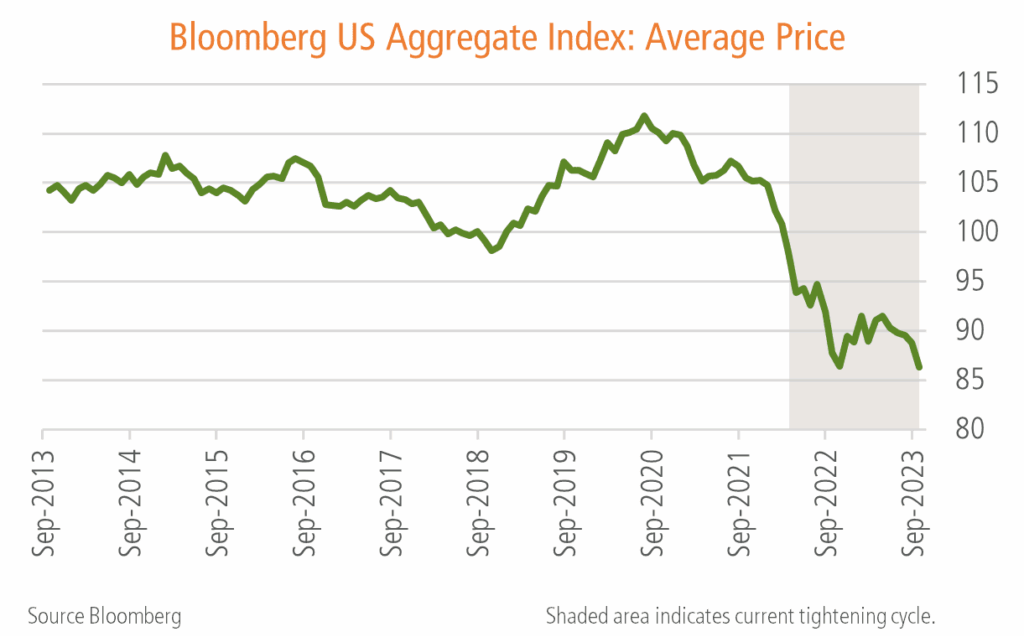

JAG Team Insights — Getting (Re) Familiar with Discount Bonds

November 15, 2023 Summary Rising interest rates have led to steep price declines in bond markets. Some bonds trade at deep price discounts even though their issuer’s credit quality remains strong. Bonds purchased at a market discount may offer a unique tax-deferral opportunity for investors. Read more…

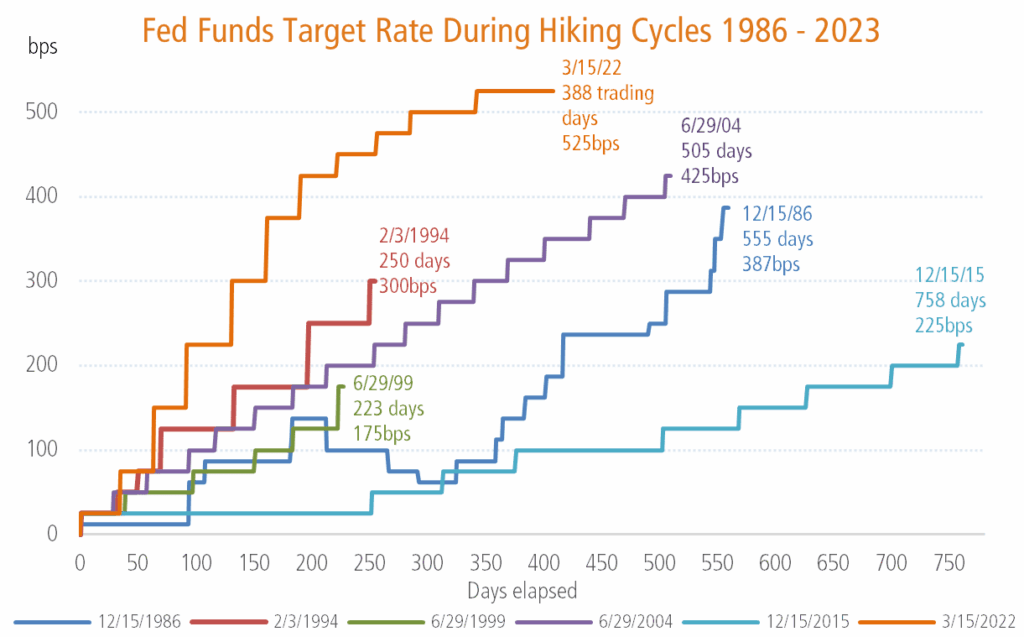

JAG Team Insights — Fixing Your Fixed Income Allocation: Back to Basics

September 30, 2023 Capital markets have been put through the wringer since the Fed started their rake hike cycle, resulting in many fixed income portfolios failing to achieve their stabilizing role in investors’ asset allocations. The Fed, by its own admission, was late recognizing the severity and persistence of inflation. Behind the curve, but determined […]